5 Simple Techniques For Check Cash Payday Loans

Wiki Article

The Main Principles Of Direct Payday Loans

Table of Contents9 Easy Facts About Payday Loans Online ExplainedThe 5-Minute Rule for Check Cash Payday Advance Loans5 Easy Facts About Fast Payday Loans DescribedGetting My Fast Payday Advance To Work

One is that numerous people who resort to payday lendings do not have various other financing alternatives. Some individuals might not be comfortable asking household members or close friends for assistance.

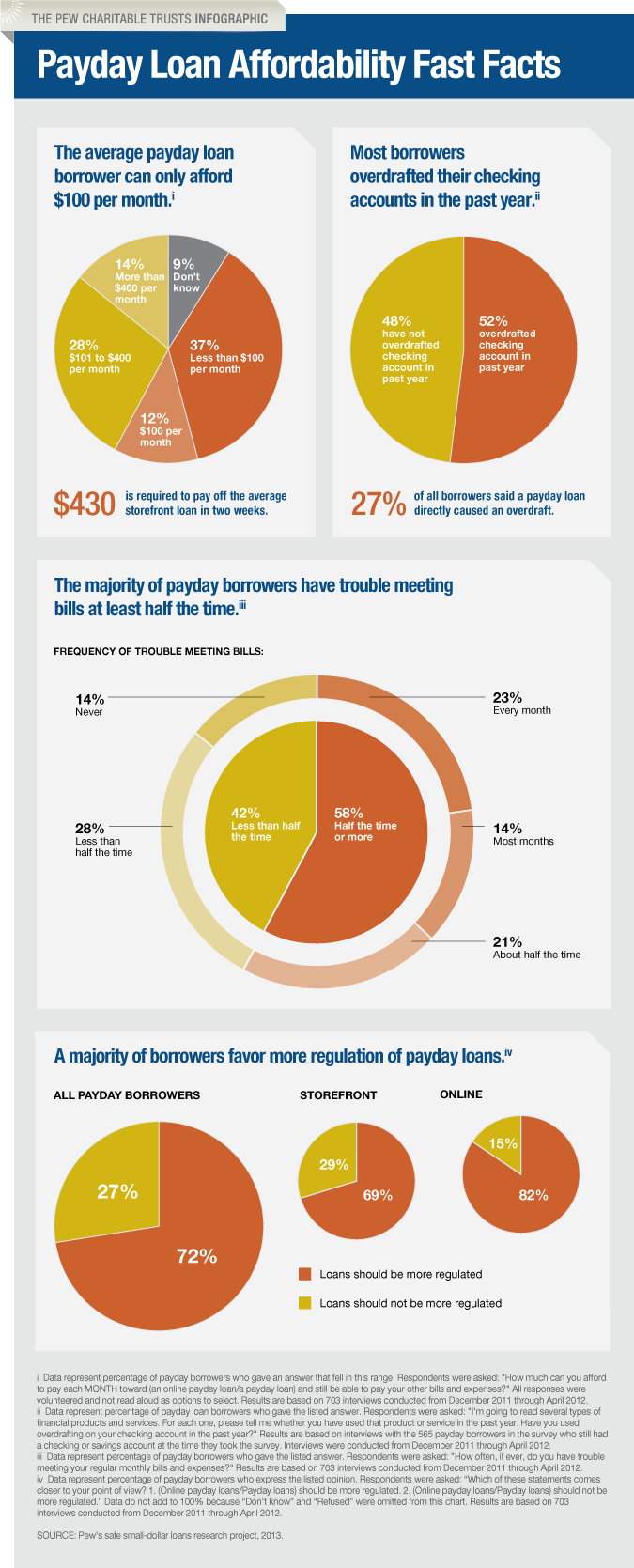

Some states, consisting of Nevada and New Mexico, also restrict each payday financing to 25% of the borrower's regular monthly income - Payday Check Loans. For the 32 states that do permit cash advance loaning, the price of the financing, fees and the maximum funding amount are capped.: 37 states have details laws that enable cash advance lending.

4 Easy Facts About Check Cash Payday Advance Loans Explained

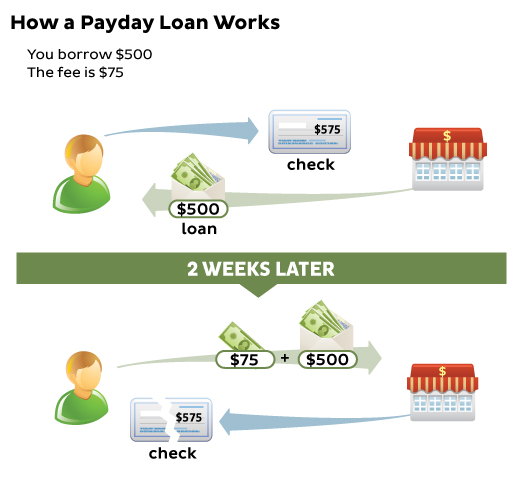

07. If the funding term were one year, you would multiply that out for a full yearand borrowing $100 would certainly cost you $391. Your lending institution needs to reveal the APR before you accept the funding. While it's normal to see an APR of 400% or greater, some payday advance have actually carried APRs as high as 1,900%.Some cash advance loan providers will use a rollover or restore feature when permitted by state legislation. If the loan is set to be due quickly, the loan provider enables the old lending balance due to roll over into a brand-new car loan or will certainly restore the existing funding again.

This gives the consumer more time to settle the finance as well as fulfill their arrangement. It additionally suggests racking up large costs if they proceed in the cycle.

That claimed, they can show up on your credit rating report if the finance ends up being delinquent and also the lending institution offers your account to a debt collector. Once a collection agency acquisitions the overdue account, it has the option to report it as a collection account to the credit scores reporting bureaus, which could damage your credit report.

Not known Details About Check Cash Payday Advance Loans

They also often tend to offer longer settlement terms, offering you more breathing space. Due to the fact that it commonly uses a reduced rate of interest price and also longer repayment term, a consolidation funding can have a reduced regular monthly repayment to assist you manage your debt payment (https://canvas.instructure.com/eportfolios/1348601/Home/Welcome).Not all states permit payday lending, but those that do require cash advance lending institutions to be licensed. If a cash advance is made by an unlicensed lender, the loan is thought about gap. This implies that the lending institution doesn't can collect or require the customer to pay back the payday loan.Each state has different regulations concerning cash advance, including whether they're available through a storefront cash advance loan provider or i loved this online.

A cash advance financing can resolve an immediate need for cash in an emergency situation. Because these fundings typically have a high APR, if you can not pay it back on time, you could obtain caught in a savage cycle of financial debt. Bottom line: It is essential to consider all your choices prior to approaching a cash advance lending institution.

Right here are a few alternatives that might satisfy your needs and also save you cash. Some personal loan providers concentrate on dealing with people with negative credit rating. Whether you need to cover some fundamental expenses, cover an emergency or settle financial obligation, you can generally get the money you need. As well as while your rate of interest will be greater than on other personal finances, they're much reduced than what you'll obtain with a payday advance loan.

The Definitive Guide to Check Cash Payday Advance Loans

And also if you have bad credit score, make certain to examine your credit rating and record to figure out which areas need your interest. In many cases, there could be incorrect information that can boost your credit history if eliminated. Whatever you do, take into consideration means you can boost your credit rating rating so that you'll have better and also more budget friendly loaning alternatives in the future. https://ch3ckc4shlns1.blogspot.com/2022/08/the-6-minute-rule-for-fast-payday-loans.html.

In Store Loans: Approval depends upon satisfying lawful, regulative and underwriting needs. Cash loan are typically for two-to-four week terms. Some debtors, nevertheless, utilize cash loan for numerous months. Cash developments ought to not be used as a lasting financial remedy, and expanded use may be expensive. Customers with credit report problems ought to look for credit history counseling.

Money advancements subject to appropriate lending institution's terms as well as conditions - https://filesharingtalk.com/members/569649-ch3ckc4shlns. ** Transunion Credit Rating, View Dashboard is a third party supplied solution.

Report this wiki page